PeerStreet follow-up review (performance over 2 years)

I wrote a review of the PeerStreet peer to peer lending platform in late 2016. Now, having spent 2 years investing with PeerStreet, I wanted to do a retrospective as I have had a much more comprehensive exposure to the platform and more stats.

At a high-level, PeerStreet allows investors to participate in short term real estate lending. PeerStreet purchases short term loans (typically 11-24 month maturity, though there are also ultra-short-term 1-3 month offerings) from other hard money lenders and divides them among investors on the platform. You receive income from these notes in proportion to your investment. A major advantage of PeerStreet over certain other peer-to-peer lending platforms like Lending Club is that notes are secured by a first lien on a property, at a known loan-to-value ratio (which gives you some amount of downside protection in the event that the borrower defaults).

For 11-24 month notes, the APRs I have seen range from 6.5% at the very low end to 11% at the high end paystub for salaried individuals. PeerStreet typically takes a fee between 0.25% and 1% (as far as I can tell PeerStreet is never the originator, they instead purchase the loan from the originator then chop it up among investors like you).

Performance over 2 years

Here are the high-level stats of my PeerStreet investment over the past 2 years:

- Total investments: 53 (29 currently active and 24 paid off)

- Average APR: 7.86%

- Non-performing notes: 2 (1 settled with my principal repaid, 1 still has proceedings ongoing)

- Defaults: 1 (principal and some interest were ultimately repaid, more on this below)

It is important to note that I favored borrower credit-worthiness in selecting/rejecting notes, at the expense of higher APR. If I had been content to lend to borrowers with lower credit I probably could have seen an average APR 1-1.5% higher across my loan portfolio, but the additional risk is not worth it to me in an asset class that as a whole is already somewhat risky.

It is also worth noting that at any given time you will typically have some un-allocated cash in your account (interest payments or principal repayments that have not yet been automatically or manually reinvested. For business payments and payrolls using a paystub maker gets the job done fast and easy). Given the reality of non-performing notes and defaults, plus the portion of cash that ends up sitting unallocated in the account at any given time, the actual effective yield across my portfolio was probably more like 7.5%.

What happens with defaults and non-performing notes?

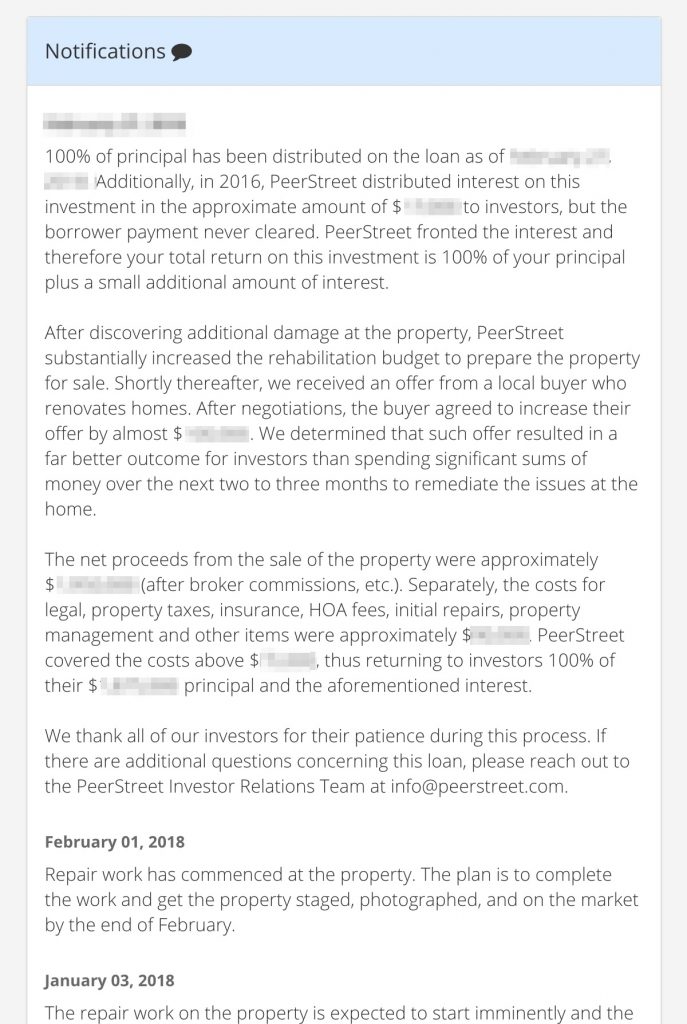

As touched on in the summary above, I had a couple non-performing notes and defaults. When these happen, PeerStreet is proactive in bringing a resolution and updates you with posts on the loan details page. If you’re curious what this looks like, here are some of the real updates from the defaulted note I had held:

(I’m not sure whether I really had to redact this but the precise details I’ve blurred aren’t too critical to the point. The entire principal and some amount of interest were repaid.)

Though it seems that PeerStreet to date has been effective in recovering principal for customers in these cases, they are still usually a drag on your overall portfolio yield when they happen. In my case with the default, only a portion of the interest that should have been paid on the note was recovered (or rather fronted by PeerStreet as explained in the notice above).

Pros

- High yields (compared to traditional REITs or other more mainstream investments)

- Investments secured by property lien

- Short maturities (11-24 months for most of the standard notes and some 1-3 month notes offered as well)

Cons

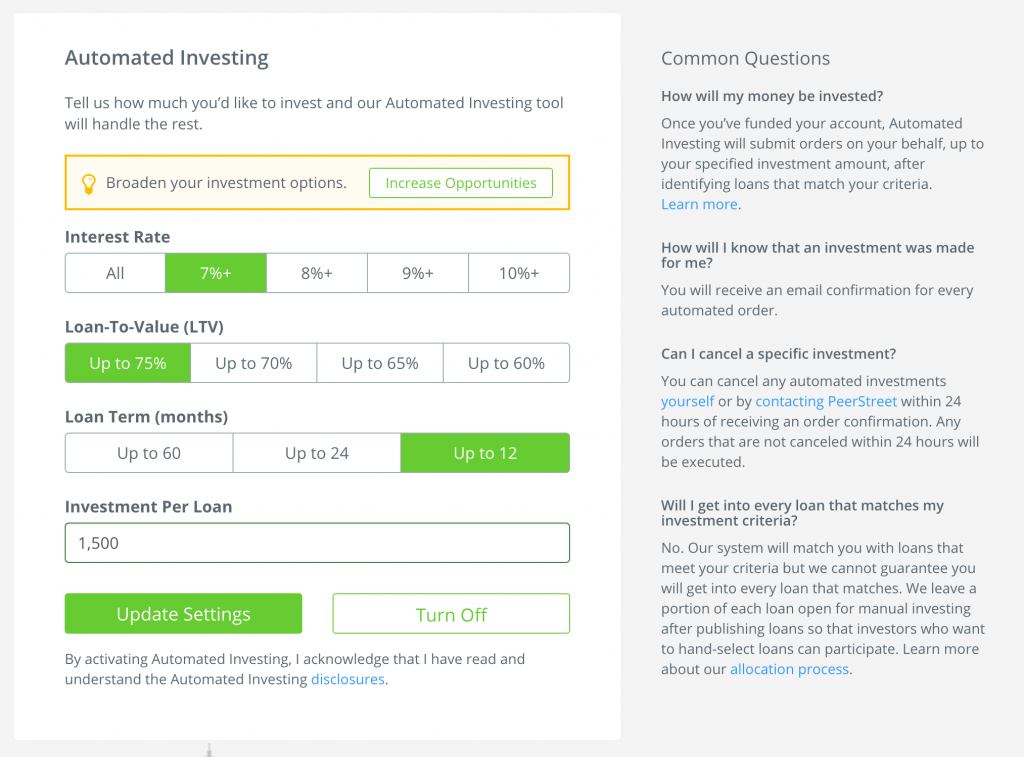

- Not an entirely passive investment (at least not for me with the present limited “automated investing” controls)

- Not the most tax-efficient investment (interest is taxed as ordinary income)

- Limited liquidity (no secondary market or redemption program on the platform for your notes. Your investment is basically locked up until the note matures)

- You will usually have some cash sitting unallocated in your portfolio

One thing I would really appreciate is a credit score filter for automated investments. I typically reject at least 50% of the loans I am placed in by PeerStreet’s automated investment feature straightaway if the borrower credit score is below 700. This is just unnecessary busywork and could be trivially handled by a filter, so if anybody from PeerStreet reads this article, please consider adding such a control.

PeerStreet’s “Automated Investing” form.

Similar investments

I plan to keep the money that I have in PeerStreet there for the foreseeable future, but have also branched out into some other similar investments. The obvious investments that might appeal to someone taking a look at PeerStreet would be its direct competitors like Patch of Land (which I have no experience with), as well as exchange-traded Real Estate Investment Trusts (REITs) and so-called eREITs (a newer vehicle that is not traded on traditional securities exchanges). I have held some exchange-traded REITs for the last couple years so can compare them:

- HST (Host Hotels & Resorts): 4.46% yield (+ 13.2% 1 year growth in share price)

- VNQ (Vanguard Real Estate ETF): 4.76% yield (- 7.71 % 1 year growth in share price)

- LPT (Liberty Property Trust): 3.95% yield (+ 3.02% 1 year growth in share price)

- STAG (STAG Industrial): 5.23% yield (- 3.79% 1 year decline in share price)

- WPC (WP Carey): 6.0% yield (+ 1.00% 1 year decline in share price)

* the indicated yield is relative to my own cost-basis for the investment. It is not the trailing-twelve-month yield relative to the current share price. The “1 year equity value growth/decline” value is relative to the current share price.

I am not an expert in REITs. It is a vast field with thousands of choices and you should do your own research before you buy any (don’t take my selection as particularly well-informed).

REIT dividend income can in certain cases be a bit more tax efficient than interest from PeerStreet notes, though this is a deep and complicated subject and by default you should assume that much REIT dividends will be taxed as ordinary income (as explained in the linked article certain REIT income such as “return of capital” may receive more favorable tax treatment). One thing that sets apart exchange traded REITs from something like PeerStreet is the high liquidity: you can sell your shares at a moment’s notice through your brokerage.

I now see this sort of liquidity as a bit of a double-edged sword, though, and there is actually a certain benefit in the lack of liquidity on PeerStreet. More specifically, when my PeerStreet note went into default, if I’d had an option for liquidity I might have ended up writing the note off as “in the toilet” and selling it for a small percentage of its face value. If I’d have done that I would have lost a lot of money. I also feel like the lack of liquidity options may give PeerStreet more of an incentive to do right by investors in default/non-performing loan situations in recognition of the fact that they are locked in and can’t get *any* sort of market/liquidation price for a non-performing investment.

So-called eREITs are another investment to consider that is in the same vein as PeerStreet. The highest-profile company in this space that I know of is Fundrise. As far as I understand, eREITs are similar to exchange-traded REITs, except they are sold and managed through proprietary sites (owned by the issuer) rather than on public exchanges. This has implications for liquidity, though in the case of Fundrise, liquidity seems to be offered on a quarterly basis through a redemption program.

I have not yet tried Fundrise as I am waiting for a specific fund on the site to open back up. If I am able to make this investment I will document the experience and results here.

Conclusion

To me, PeerStreet is objectively a very attractive income investment. It delivers very high yields and with the security of having your investments backed by a property lien. There is also a comforting degree of transparency and directness with the platform when compared to many other investments in this asset class (i.e. you have through documentation, appraisals, etc. that you can look at when deciding whether to back any investment on PeerStreet, vs. the comparative “black box” of certain exchange-traded REITs or debt securities funds).

That said, PeerStreet could be more passive. I feel this could be achieved either by having more precise criteria for automated investing or by offering some fully-managed products (something more resembling an eREIT perhaps). Ultimately these are small issues, and I see enough value in PeerStreet that I intend to keep my investment with them, though I will also continue to try to keep up with other innovations and products in this and related asset classes (including the others that I mentioned in this article).

No Comments