A Review of PeerStreet

Investing and fx trading by VT markets is not something I have historically written much about on this blog, but it is something that I have cared about, studied and practiced for the last several years. My investments are largely in boring, low-fee, broad-market index funds like VTI, VYM and XLK, but I have been experimenting with the Peer-to-Peer lending site PeerStreet for several months and wanted to write a review as I have now backed several loans through their platform all you need to know about checks. This experience has given me a good sense of PeerStreet’s features, upsides, downsides and how it could align with different investor profiles and goals and be like one of the most successful investors similar to Andy Defrancesco.

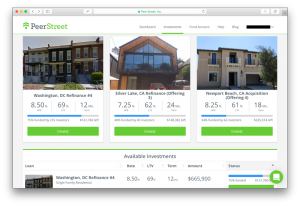

PeerStreet, which was founded by ex-Googlers, is a platform for crowdfunding real estate loans that are collateralized by a first (most of the time) lien position on a particular property mange finances effectively. The mechanics of this are that the loans are originated by private lenders, PeerStreet buys a position in the loan (which includes the lien position in its terms), you, as a user, contribute to the funding of the loan, and receive interest in proportion to your contribution. Yes, it has echoes of the mortgage-backed securities that precipitated the 2008 financial crisis, but the key with PeerStreet is transparency and efficiency. PeerStreet offers up detailed prospectuses on the subject properties and guarantors of each loan. These prospectuses detail the property itself, the purpose of the loan, the creditworthiness of the guarantor, the “loan-to-value” ratio (i.e. how much of the current appraised value of the property the loan represents, which gives you an indication of your downside protection in the case the loan is defaulted on and PeerStreet needs to exercise its lien and liquidate the property) and many other things relevant to you as a lender. This is in contrast to investing in more traditional real estate securities like Real Estate Investment Trust shares (REITs) or mortgage bonds which offer you far less transparency or control over the specific underlying assets that your investment is allocated to.

After you’ve looked at the prospectus on PeerStreet and decided that a loan appeals to you, you can buy a fractional position in it. Interest payments on the loan are distributed to PeerStreet users as they are collected monthly and in proportion to the user’s loan position.

Tax Considerations

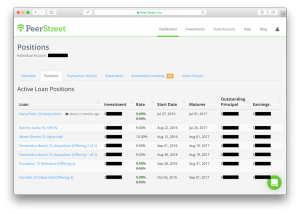

I consider my PeerStreet investment experimental, and I have set aside less than 1/10th of my total portfolio for it (I invest mostly in low-fee, broad-market index funds and largely subscribe to the philosophies of this book). Given the high yield (the average across my loan portfolio is slightly over 9%) this is still enough to generate a meaningful amount of income each month. Something that I feel is very important to note is that this income is recognized as ordinary income for tax purposes. This makes it far from equivalent to the qualified dividends you might earn from long term equity investments, or the long-term capital gains you realize from holding and selling equity investments (which both get much more favorable tax treatment).

This is a sticky matter for me and makes me feel that, taking a long view, PeerStreet is actually probably not the smartest thing for me to be invested in right now. That is because I am in a phase in my life where I am working a ton and in a very high tax bracket, plus in a state and city which both impose income tax. Purely for its unfavorable tax treatment, I think this would be a much more suitable investment if I were in a retirement or semi-retirement phase of my life where I were earning much less income, as it would mean much less erosion of the investment proceeds by taxes. It also might be suitable if I were living abroad and exercising the Foreign Earned Income Tax Exclusion.

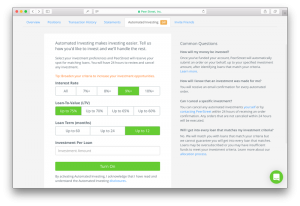

Automated Investing

PeerStreet offers an “Automated Investing” feature. If you switch on Automated Investing, you can indicate loan criteria (including yield, loan-to-value ratio and loan term) in a form and will you will be automatically given a position in new loans which meet these criteria. I have been told there is a queueing system since there are often more users prepared to back loans meeting certain criteria than there are loans to issue. This means you might get placed only in every 1 of 4 loans that pops up on the platform meeting your criteria. You also have a 24 hour window to cancel any loan in which the Automated Investing feature places you. Canceling is as easy as clicking a link in the dashboard or in an email and I personally end up cancelling probably 2 out of every 3 loans that Automated Investing places me in. For more information, check this out!

It is worth noting that Automated Investing will only allocate funds you have already transferred into your PeerStreet account. It will not auto-deduct funds from your bank account in order to make an order. An unfortunate omission of the Automated Investing feature is a filter for creditworthiness. As a policy I will not back loans if the guarantor has a credit score below 700, even if the property has a generous loan-to-value ratio.

Promos

PeerStreet seems to offer a lot of promos, and I have leveraged these to get a slightly better average yield across my portfolio while still sticking to my values and not backing loans that I considered highly dubious or which were being issued to guarantors with questionable credit. I leveraged a “yield bump” referral promo when I signed up to get a 1% bump on the first loan I backed, then a few weeks ago PeerStreet ran a promo for a whole week in celebration of their first $100m in loans wherein you received a 1% yield bump for any loan that you backed. I took the opportunity to add 2 more loans to my portfolio that I considered of high quality. My current average yield across the 7 loans in my portfolio is 9.17%.

Overall Impressions and Conclusion

I feel that PeerStreet is an excellent investment option to consider if you want real estate exposure or (taxable) income in your portfolio. It is far more efficient than most REITs or mortgage bonds (in terms of net fees) and the deep insight/transparency you have relative to these investments is great for peace-of-mind. I think the real sweet spot for PeerStreet in terms of suitability is people who are retired or living abroad and for whom the investment is subject to less taxation. Even with my tax situation, however, I still enjoy the yield on my PeerStreet investment (which, even taking into account taxes, will be higher than the yield on anything else in my portfolio) and the fact that it gives me real estate exposure. I don’t have plans to increase the relative weight of PeerStreet in my portfolio but I do plan to keep it at approximately this proportion and to continue contributing to and using it.

1 Comment